If you’re gearing up for a real estate sale or purchase in 2025, you need to know what’s happened over the last 12 months. Today I’ll be recapping the national real estate trends that we experienced in 2024.

If you’re anything like me, you’re winding down your year reflecting over the last 12 months and eagerly looking forward to the new year ahead. Whether you’re considering a new primary residence or you’re focused on building your investment portfolio, it’s always a great use of time, especially at the end of a year to look back at where we started and where we are today so that we can make smart decisions as we begin the next real estate selling cycle. Today, I’m going to break down the highlights of this 2024 residential real estate market with a few predictions for 2025 sprinkled in at the end. Let’s get started.

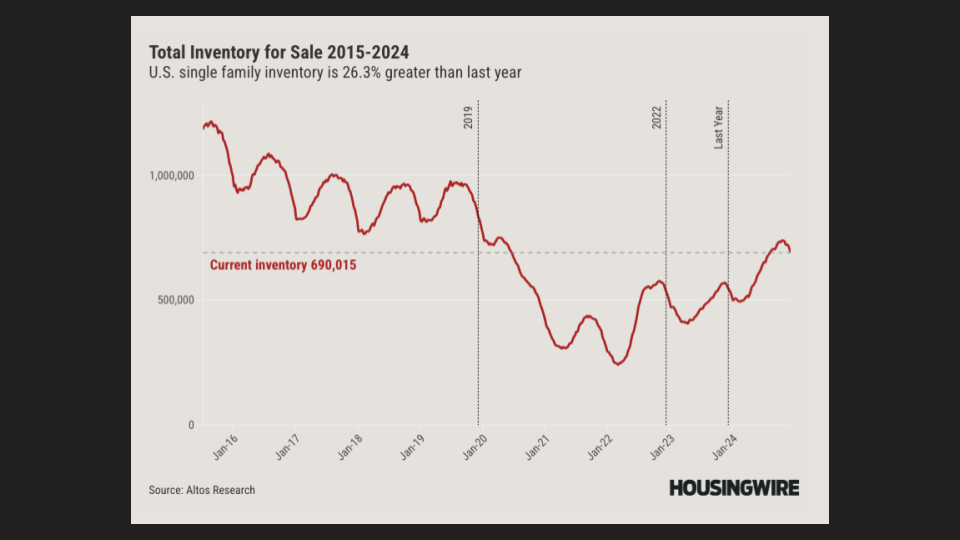

Inventory is growing

We are wrapping up 2024 with 26% more homes on the market than last year at this time and this is only 17% fewer homes on the market than what we had at the end of 2019.

Notice how the end of each year bottoms out at a lower value through 2022. During this period from 2015-2022, mortgage rates were on a continuous downward trend causing demand for housing to remain high. This demand came to an abrupt halt over the last three years as money became more expensive beginning the second half of 2022. To quote Mike Simonsen of housing wire, “when demand slows, inventory grows.”

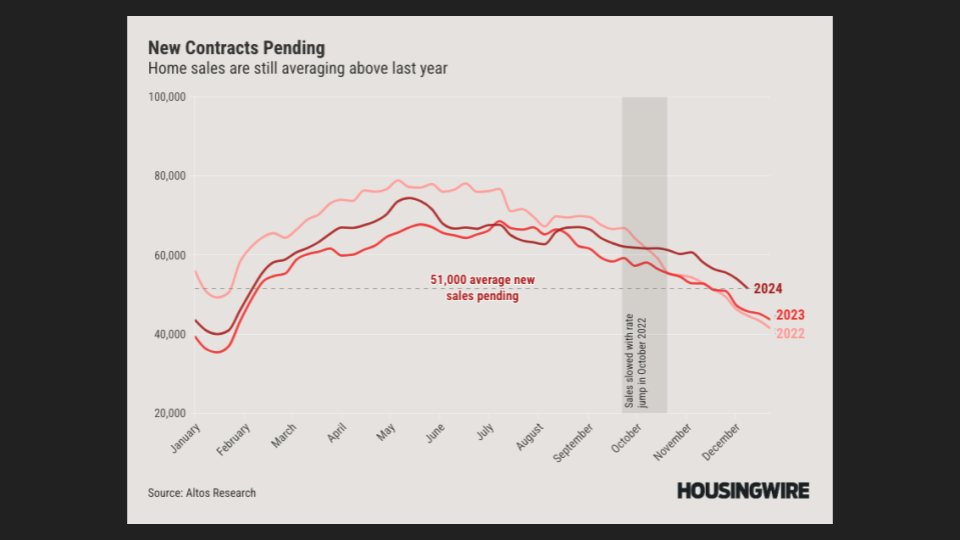

Pending Home Sales are Up

Although sales feel slow compared to the pandemic surge, we have seen more sales nationwide almost every month of 2024 than we saw in 2023. The sluggish feeling of this year is in large part, in my opinion, due to the lock-in effect where there are just fewer sellers bringing their home to market because they aren’t thrilled to let go of their lower interest rates in exchange for a rate significantly higher when home prices haven’t come down. With this said, the further in the rearview mirror those low interest rates become, we are noticing a loosening of the grip of that lock-in effect.

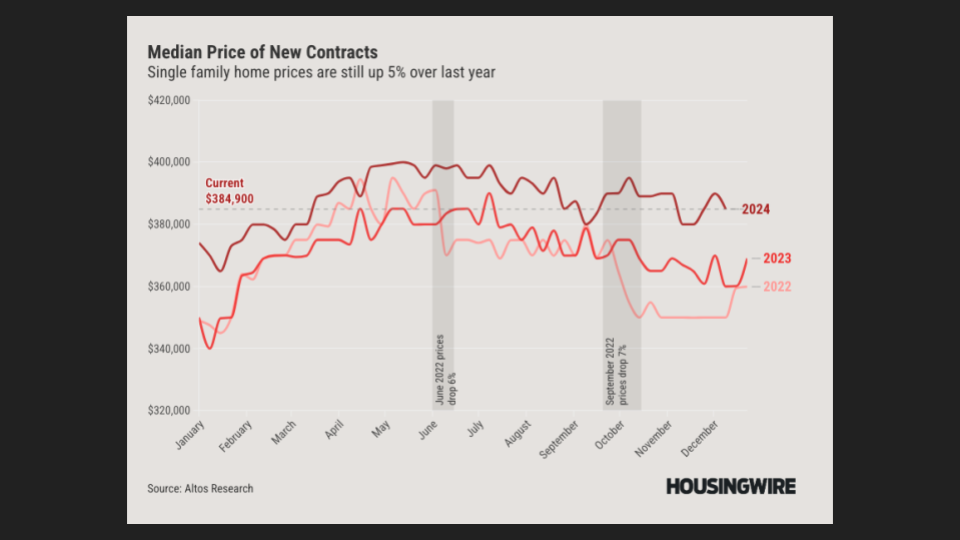

Home Prices Hold Up

Home prices nationally are up about 5% over last year.

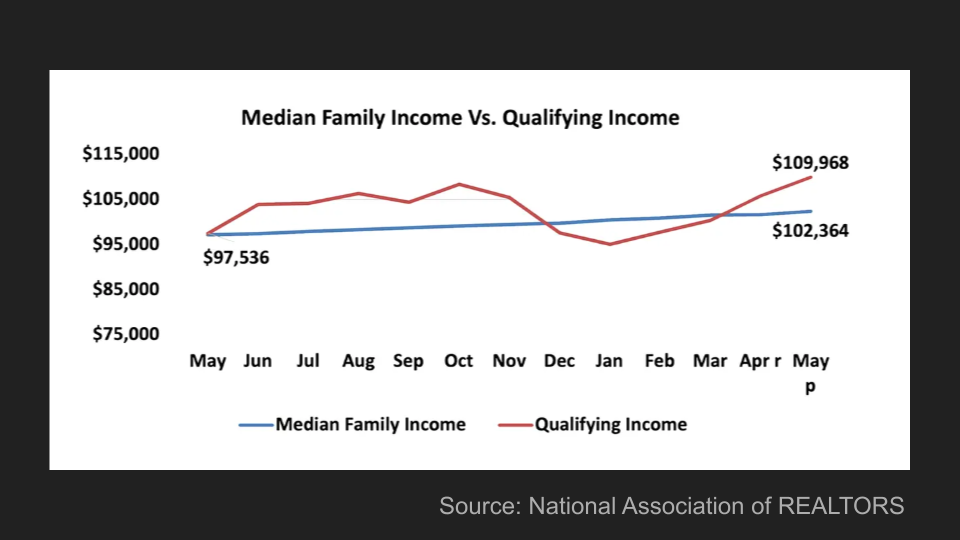

Affordability Pains

The Housing Affordability Index uses data provided by the National Association of Realtors (NAR). It measures whether a family earning the national median income can afford the monthly mortgage payments on a median-priced existing single-family home. An index value of 100 means that a family has exactly enough income to qualify for a mortgage on a home. The higher the index value, the more affordable a house is to a family.

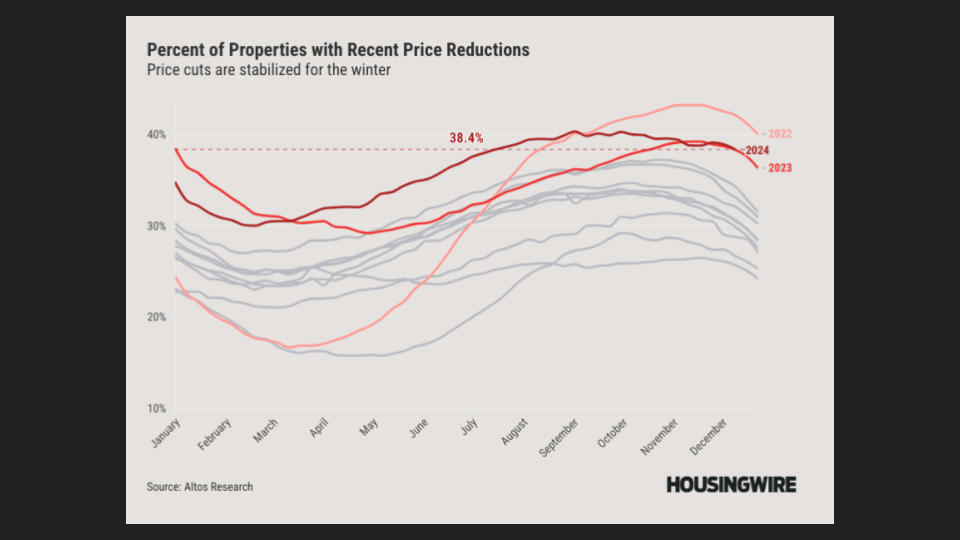

Price Drops

Nationwide the percent of properties with price reductions has come in at 38.4%. This is aligned similarly to 2023, which is below the number of price cuts in 2022 yet notice all these grey lines lower on the chart. The lowest of which, is 2020 when we had only 25% of listings with a price drop nationwide. You can also tell from this chart that it’s not uncommon to have the highest number of price drops at the start of the 4th quarter as sellers want to incentivise buyers to make offers.

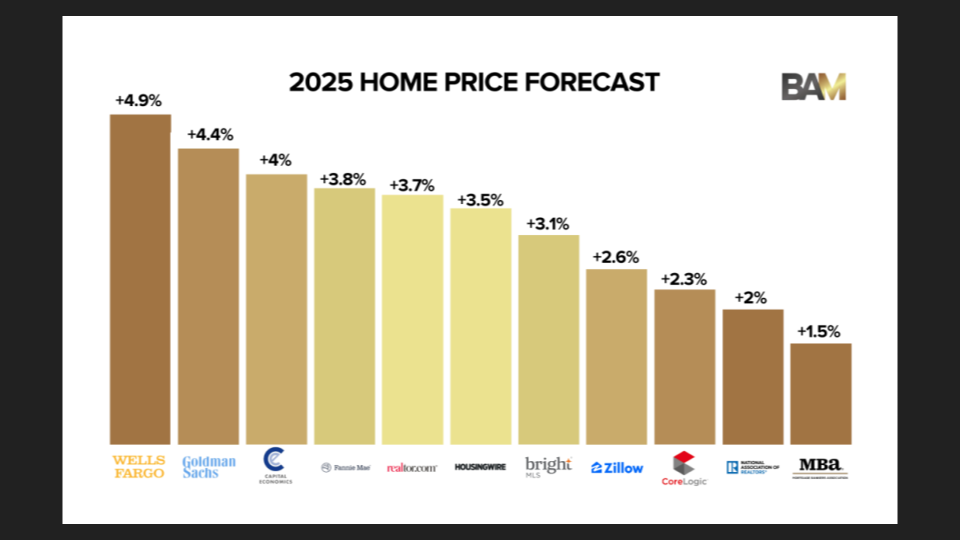

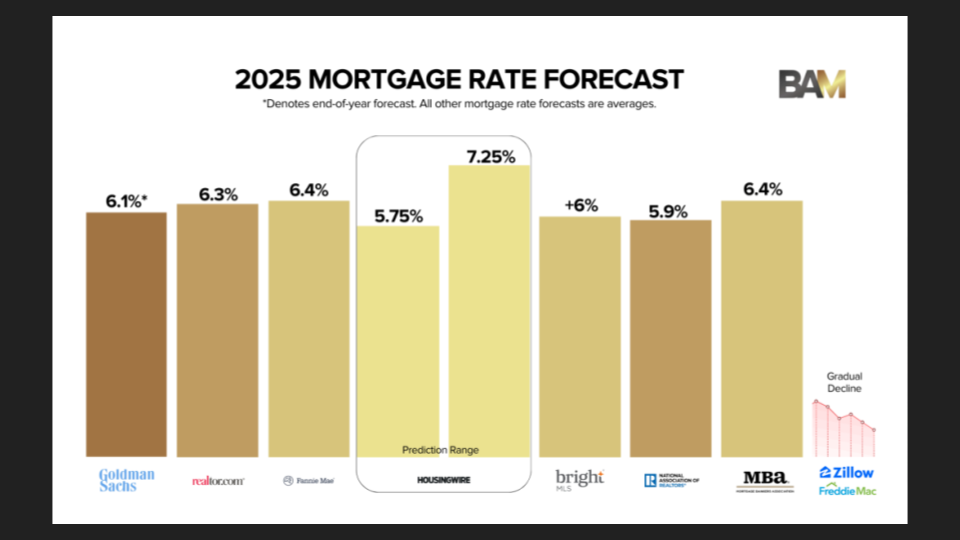

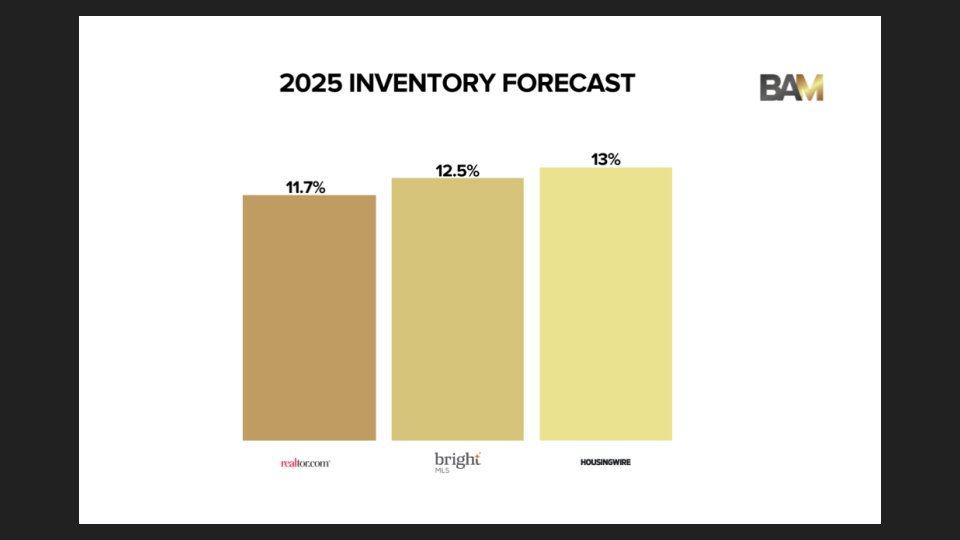

2025 Predictions

Mortgage rate predictions

Inventory predictions

Home price forecast